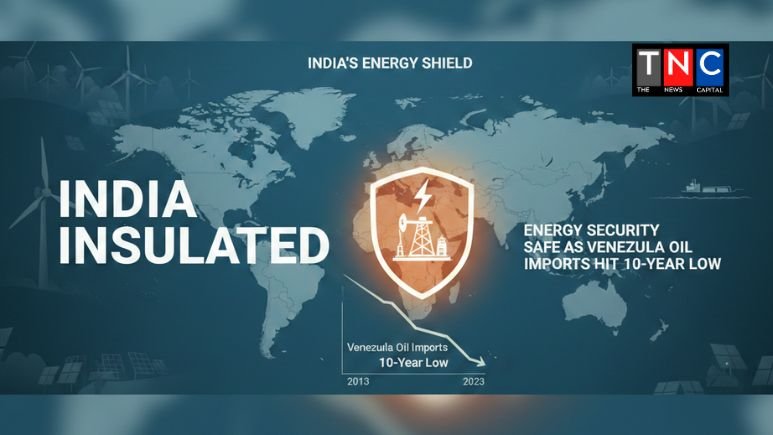

While the capture of Nicolás Maduro in “Operation Absolute Resolve” has sent shockwaves through the Caribbean, New Delhi remains calm. New data reveals that India’s energy security is largely decoupled from the crisis, with Venezuelan crude now making up a mere fraction of a percent of national imports.

The Indian government and energy analysts on Monday (January 5, 2026) assured that the dramatic U.S. military intervention in Venezuela will have a “negligible” impact on India’s energy security. Trade data from the Ministry of Commerce shows India imported just $255.3 million worth of oil from Venezuela in the current financial year up to November 2025, accounting for a tiny 0.3% of India’s total oil basket. This marks a massive drop from 2013, when India was the second-largest buyer of Venezuelan crude, importing over $13 billion annually.

The once-strong energy connection between Caracas and New Delhi has been gutted by years of U.S. sanctions and shifting geopolitical priorities.

- The Russian Pivot: India has largely replaced its heavy Latin American crude with discounted Russian Urals. As of late 2025, Russia remains India’s top supplier, holding a 35–44% market share, followed by traditional Middle Eastern partners Iraq and Saudi Arabia.

- Stranded Assets: Despite low import volumes, India remains a stakeholder in the Orinoco Oil Belt. ONGC Videsh, Indian Oil Corporation, and Oil India have frozen equity in projects like San Cristóbal and Carabobo-1. These firms are currently owed nearly $1 billion in unpaid dividends and dues.

- Technical Readiness: While trade is low, Indian refiners like Reliance Industries and Nayara Energy have some of the world’s most advanced “complexity” ratings, meaning they’re technically set up to process the heavy, high-sulfur crude that Venezuela produces.

Paradoxically, the U.S. takeover of the Venezuelan energy sector, which President Trump has vowed to “rebuild” with billions in private investment, could actually benefit Indian state-run firms.

- Debt Repayment: Analysts suggest a U.S.-managed “Board of Technocrats” in Caracas may prioritize clearing outstanding debts to international partners, including India’s $1 billion claim, to encourage reinvestment.

- Supply Diversification: If U.S. oil majors like Chevron and ExxonMobil succeed in restoring Venezuela’s production to its target of 3.2 million barrels per day by 2027, India could become a key buyer again, providing a critical hedge against volatility in the Middle East.

“…and the large geographical distance, the current developments in Venezuela are not expected to have any meaningful impact on India’s economy or energy security,” Ajay Srivastava, founder of the Global Trade Research Initiative, said.

“We are not dependent on Venezuela for oil. Our trade is very little… so this is not going to affect India in any big way,” former Indian Ambassador to Venezuela R. Viswanathan added.

Strategic Opportunity: The $1 Billion Recovery

While the immediate impact is negligible, industry experts suggest a U.S.-led restructuring of Venezuela’s state oil firm, PDVSA, could be the “golden ticket” for Indian state-run companies to recover long-stalled assets:

- ONGC Videsh: The firm is owed roughly $1 billion in unpaid dividends from its 40% stake in the San Cristóbal oilfield. Under U.S. oversight, OVL could finally see these dues cleared through future crude shipments.

- Production Revival: Output at San Cristóbal has plummeted to just 5,000–10,000 barrels per day. With U.S. technology and rigs potentially moving back in, OVL hopes to ramp production back up to 100,000 bpd, providing a significant boost to its international portfolio.

- Refinery Advantage: Reliance and Nayara Energy operate some of the most complex refineries globally. If Trump’s promised “rebuilding” of Venezuela’s infrastructure succeeds, these Indian firms would be first in line to buy heavy crude, which is often cheaper and works well with their advanced processing units.

As 2026 begins, India’s energy strategy looks robustly diversified. The transition in Caracas, while violent and politically messy, may eventually offer New Delhi a critical third pillar of supply to balance its reliance on Russia and the Middle East. However, until the “second wave” of potential strikes mentioned by President Trump is avoided and a stable governing framework is set up in Caracas, Indian refiners are expected to stay on the sidelines, maintaining their cautious 0.3% exposure.

Also Read / Trump demands Venezuela return ‘stolen’ oil assets after ordering naval blockade.

Leave a comment