In 2025, the topic on every American’s lips isn’t just inflation or the job market it’s the buzz around former President Donald Trump’s newest economic policy proposal: the $2,000 Tariff Dividend. Amid fierce election campaigns, Trump unveiled a plan to redistribute revenues from expanded tariffs, promising direct payments to millions of U.S. households. The “Trump tariff dividend 2025” caught headlines, sparked political debate, and left citizens wondering about how it would really affect them.

This blog demystifies the plan, examining who qualifies, how the payments are structured, the mechanisms behind the policy, and its broader implications for every American’s wallet and for the U.S. economy as a whole.

What Is the Trump Tariff Dividend?

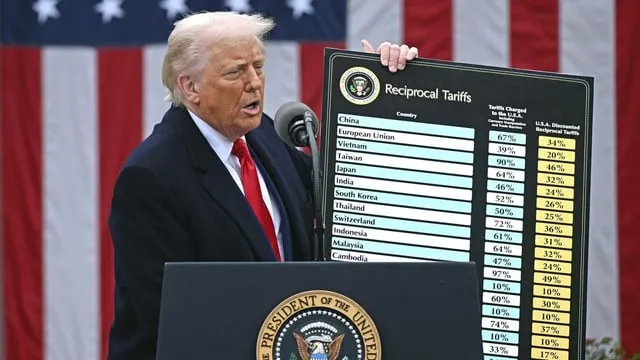

The “Trump tariff dividend” is an annual cash payout of up to $2,000 per household, sourced from revenue generated through new and existing tariffs on imports especially products from China, Mexico, and the European Union. Unlike traditional stimulus checks, the dividend ties directly to the “success” of tariff enforcement, with Trump arguing it will make America’s trade policies “work for the people, not just the government.”

The proposal is pitched as a win-win: punish foreign competitors for unfair trade practices, and reward American consumers using the proceeds.

Who Qualifies for the $2,000 Dividend?

Eligibility for the Trump tariff dividend is designed to be broad, but with some income, residency, and documentation requirements:

- U.S. Citizens and Legal Residents: Both categories are eligible. The dividend is distributed per household rather than per person.

- Income Thresholds: Households earning below $200,000 qualify for the full $2,000. Those above get a reduced amount based on a sliding scale.

- Tax Filing Required: Recipients must have filed federal taxes for the previous year, ensuring documentation and bank info for direct deposit.

- Non-Recipients: Undocumented immigrants, foreign nationals, and those not filing taxes won’t receive the dividend.

Trump’s campaign materials emphasize simplicity and minimal paperwork modeled after COVID stimulus programs.

How Will the Tariff Dividend Work in Practice?

1. Tariff Collection:

The federal government imposes or increases tariffs on imported electronics, automobiles, machinery, and select agricultural products. These tariffs are paid by importing companies, which often pass some costs to consumers.

2. Revenue Pool:

Collected tariff revenues are placed in a dedicated “Dividend Fund,” managed by the Treasury. Congressional oversight is proposed to ensure transparency.

3. Distribution Mechanism:

Each spring, the fund pays out up to $2,000 to eligible households via direct deposit or check. If revenue exceeds projections, additional dividends may be considered; if under, the payout might dip.

4. Oversight and Review:

Annual audits and quarterly reporting ensure money isn’t diverted and the process works as advertised.

Economic and Political Rationale

Trump positions the dividend as the next step in “America First” economics:

- Protecting Industry: Tariffs punish countries viewed as cheating or subsidizing exports, theoretically boosting U.S. manufacturing and jobs.

- Rewarding Consumers: The dividend offsets higher prices by handing citizens a chunk of the revenue.

- Political Appeal: The plan is popular among working- and middle-class voters, especially those who struggled during inflationary surges and stagnating wages.

Proponents argue it’s time for tariffs to benefit ordinary Americans not just government coffers.

Critics and Controversies

Economists and political opponents warn of several pitfalls:

- Inflation Risk: Tariffs often raise prices for imported goods, impacting everything from cars to household electronics. While the dividend offsets some pain, it may lag behind actual cost-of-living increases.

- Trade Retaliation: Countries hit with tariffs may respond with their own, hurting U.S. exports, farmers, and manufacturers.

- Supply Chain Disruptions: American companies reliant on foreign components may face delays and higher costs, shrinking choice for consumers.

- Fiscal Uncertainty: If trade volumes fall or foreign suppliers find alternatives, tariff revenues may drop leading to reduced dividends.

Despite these warnings, polls show strong support among voters who see direct payments as more tangible than complex tax credits or targeted relief.

Real-World Impact: Who Stands to Gain?

- Working and Middle-Class Families: These households, often stretched by bills and price hikes, see the dividend as a badly needed financial boost.

- Rural and Rust Belt America: Voters in states with lost manufacturing jobs or struggling farmers are enthusiastic, viewing the dividend as a way to reclaim lost prosperity.

- Small Businesses: Owners who qualify get extra capital, although they may also face higher costs on imported goods.

Some large corporations and wealthy Americans lament the broader economic fallout, but direct-to-household relief wins significant grassroots favor.

How Should Americans Prepare?

- Review Tax Filings: Ensuring all documentation is up to date will speed dividend payments.

- Budgeting: Households should weigh the dividend against possible price hikes when planning purchases.

- Stay Informed: Following updates from the IRS and Treasury is vital as details may change based on Congressional negotiations.

If implemented, the “Trump tariff dividend 2025” could become a cornerstone of household financial planning, especially for families hit hardest by inflation.

Conclusion: A Tariff Revolution or Temporary Relief?

Whether the Trump tariff dividend becomes law or remains a campaign promise, it has reshaped the debate on trade, stimulus, and citizen-driven policy. For millions of Americans, the prospect of a direct tariff-funded payment is enticing offering a break from economic hardship and a signal that trade can serve everyday needs.

Yet, as with any bold economic reform, its impact will stretch beyond wallets shaping how America engages the world, how consumers navigate cost pressures, and how policy makers balance populism with long-term stability.